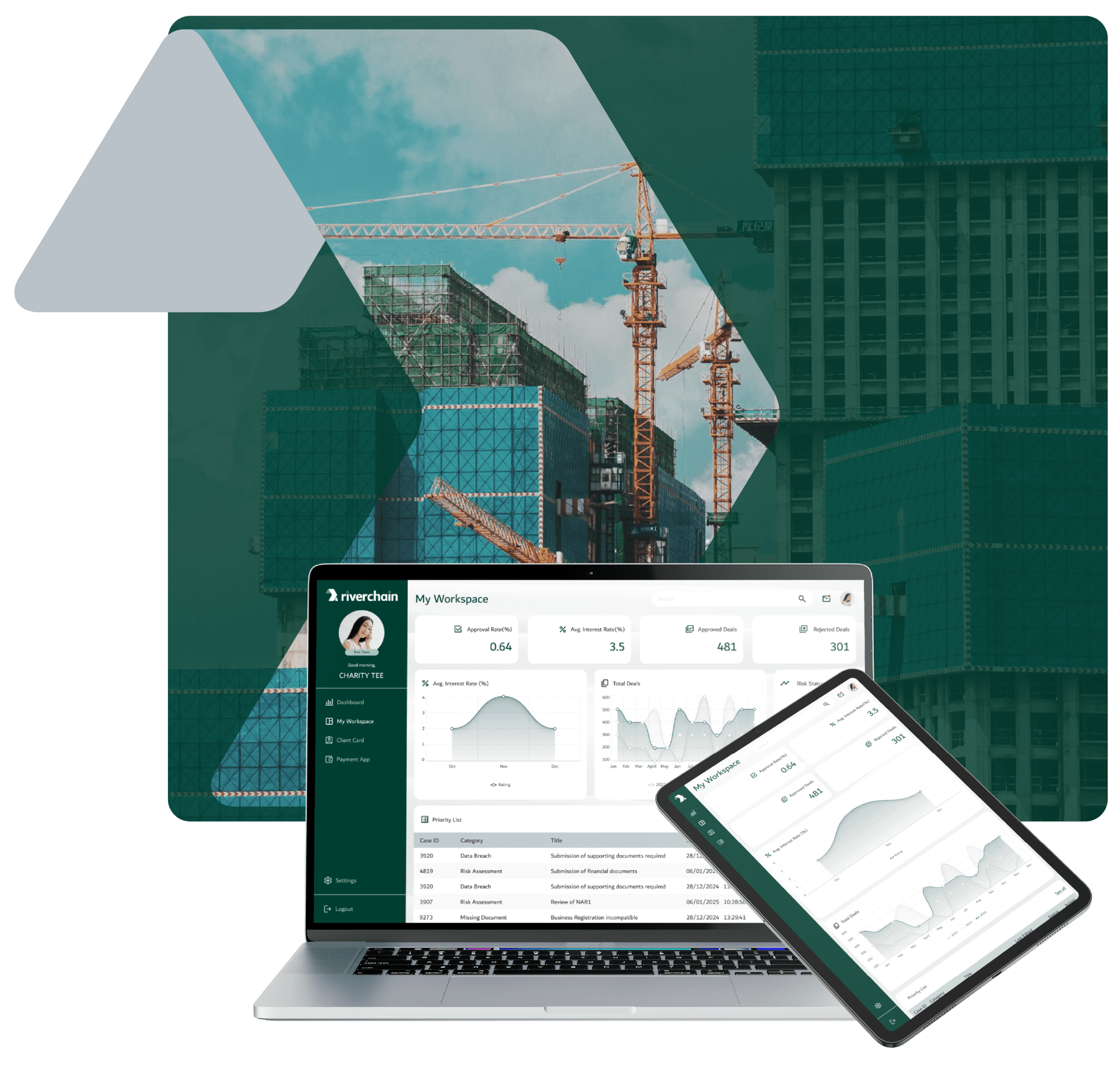

Working capital solutions

tailored to the construction industry

Powered by its proprietary technology and deep industry experience, Riverchain simplifies access to financing solutions to champion the growth and success of construction companies.